I'm not really convinced that GE's removal from the Dow is a bad thing in the long run. While a negative in the near-term [for GE], please note that recent removals from the index have gone on to outperform the DJIA in the 12-months following the announcement

One thing this news tells us is that GE's industrial manufacturing days are over as the economy shifts to a more service orientation.

Time and time again, new trends replace old ones in the Dow. For example, take Cisco replacing General Motors in 2009 or Nike replacing Alcoa in 2013.

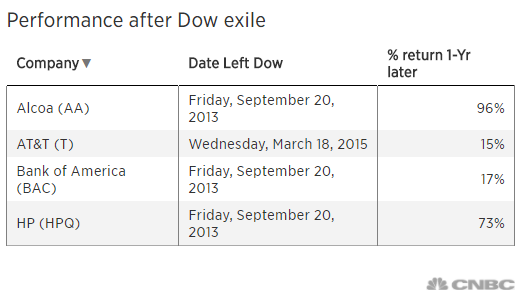

In fact, most other recent removals from the Dow before General Electric soundly outperformed the S&P 500 in the year after getting booted, according to CNBC data.

AT&T shares rose 15 percent in the 12-months after it got replaced by Apple in the Dow versus the S&P 500's 2 percent decline in the same time period.

Alcoa's stock soared even higher with 96 percent return in the year after its exit.

It seems that by the time the index committee acts to remove an underperforming stock, most of the fundamental deterioration is already PRICED INTO the shares and so you see a rebound.

GE shares fell as much as 3 percent in after hours trading following the decision Tuesday. After opening lower on Wednesday, the stock rebounded to near positive.