Summary: Perhaps the most important frontier in microeconomics is the effect of debt on growth, especially private sector debt (government debt has different dynamics). Many economists have attempted to integrate debt levels into mainstream theory (e.g., Hyman Minsky). While so far unsuccessful, research has produced many useful insights. Here is a new study with a powerful conclusion: “An analysis of business cycles in 30 mostly advanced economies finds that burgeoning household debt is a strong indicator of an impending economic downturn.”

This is a follow-up to Fact & myth about the debt supercycle, a story of modern America.

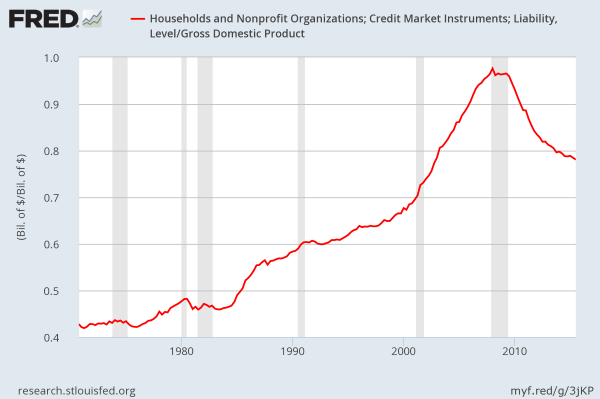

Look at the end of this article to see America’s ratio of household debt to GDP.

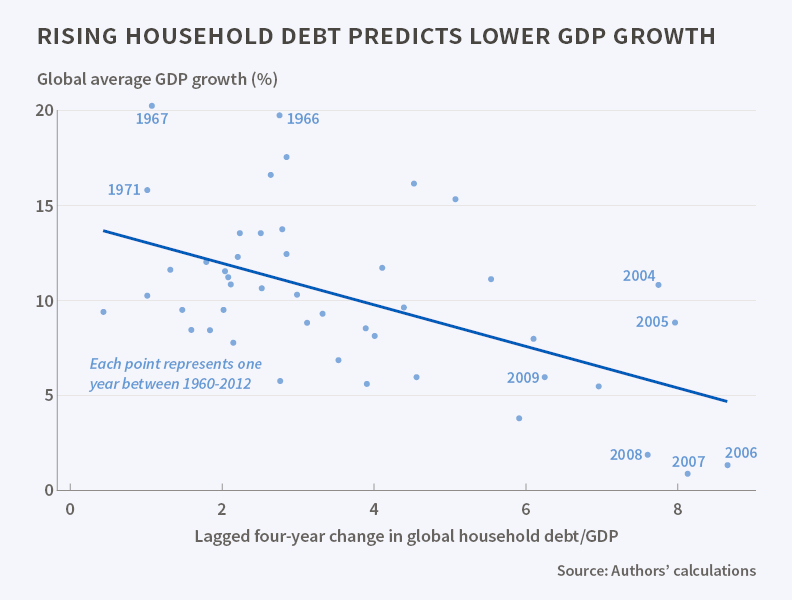

“Household Debt and Business Cycles Worldwide”An increase in household debt in relation to a country’s GDP is, at least in the short to medium term, a strong predictor of a weakening economy, according to an analysis of data from 30 nations by Atif R. Mian, Amir Sufi, and Emil Verner. The researchers use slowing growth and rising unemployment as key indicators of weakening. They find that the household debt factor is a better predictor of downturns than the debt of non-financial firms.

In “Household Debt and Business Cycles Worldwide“, the researchers analyze databases from the Bank for International Settlements, the World Bank, the Organization for Economic Cooperation and Development (OECD), and the International Monetary Fund (IMF) over the last half-century. They find that a rise in household debt, largely produced by more readily available credit, is a valuable forecaster of a contracting economy, citing as a prime example the growth of household debt in the early to mid-2000s and the slowing of global growth in the latter part of that decade.

The researchers see lower credit spreads and increases in risky debt as primary factors driving the rise in household debt. The availability of cheap credit spurs borrowing to finance higher consumption. In particular, household spending as a share of income rises during household debt booms, as do total imports and the share of consumption goods in total imports.

The expansion in household debt is followed by a sharp slowdown in GDP, consumption, and investment growth. This slowdown is not anticipated by professional forecasters at the IMF and OECD, giving household debt the ability to predict growth forecast errors.

The expansion in household debt is also followed by a sharp reversal of the current account balance, driven primarily by a fall in imports. If a number of countries are experiencing household debt growth at the same time, net export margins are unlikely to help an individual country export its way out of a downturn. Countries with a household debt to GDP cycle in line with that of the global debt cycle therefore see even larger declines in future output growth following a rise in household debt.

The researchers state that their approach to relating changes in household debt to subsequent GDP would have predicted a fall in global GDP growth during the 2007 to 2012 period. “The Great Recession was not an extreme outlier,” they write, but “followed a pattern we would expect given the tremendous rise in global household debt that preceded it.”

They acknowledge that predicting economic developments is prone to error and miscalculation, but argue that their study nevertheless suggests that considering periods of rapid growth in household debt in relation to GDP is a useful means of foreseeing periods of economic retrenchment.

——————————— End article ———————————

America’s ratio of household debt to GDP.

Our household debt to gdp level has falled by a fifth from its peak — and still falls, albeit at a slowing rate of descent (non-profits have relatively little debt). So we’re OK in terms of htis analysis.

Unfortunately that’s not the full story. Household is still too high for a nation locked into slow growth, especially with so much of the debt held by boomers nearing retirement — when their ability to service the debt will drop, as many lack the retirement assets and income to service the debt. We might see large-scale bankruptcies by boomers during the next two decades.

Our household debt to gdp level has falled by a fifth from its peak — and still falls, albeit at a slowing rate of descent (non-profits have relatively little debt). So we’re OK in terms of htis analysis.

Unfortunately that’s not the full story. Household is still too high for a nation locked into slow growth, especially with so much of the debt held by boomers nearing retirement — when their ability to service the debt will drop, as many lack the retirement assets and income to service the debt. We might see large-scale bankruptcies by boomers during the next two decades.

A rise in the household debt to GDP ratio predicts lower output growth and higher unemployment over the medium-run, contrary to standard macroeconomic models. GDP forecasts by the IMF and OECD underestimate the importance of a rise in household debt to GDP, giving the change in household debt to GDP ratio of a country the ability to predict growth forecasting errors.

We use lower credit spreads and increases in risky debt issuance as instruments for the rise in household debt to GDP to argue that our results are supportive of recent models where debt growth is driven by changes in credit supply, borrowing constraints, or risk premia.

We also show that a rise in household debt to GDP is associated contemporaneously with a rising consumption share of output, a worsening of the current account balance, and a rise in the share of consumption goods within imports. This is followed by strong external adjustment when the economy slows as the current account reverses and net exports increase due to a sharp fall in imports.

Finally, an increase in global household debt to GDP also predicts lower global output growth. The pre-2000 predicted relationship between global household debt changes and subsequent global growth matches closely the actual decline in global growth after 2007 given the large increase in household debt during the early to mid-2000s.

http://investmentwatchblog.com/rapidly-rising-household-debt-predicts-recessions-see-americas-future/