Stephen Moore

@StephenMoore

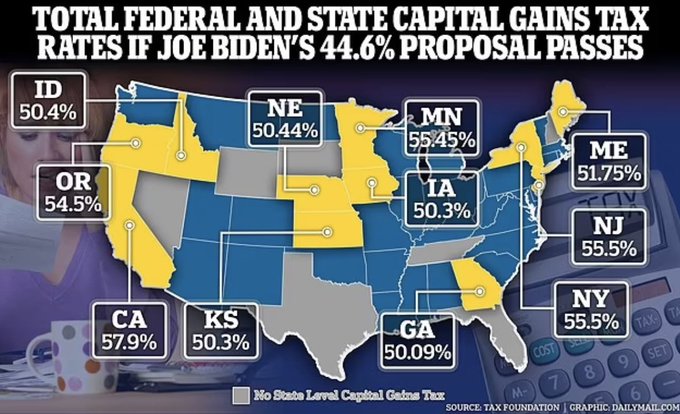

Capital gains tax rates under Joe Biden's plan:

Georgia - 50.09%

Iowa - 50.3%

Kansas - 50.3%

Idaho - 50.4%

Nebraska - 50.44%

Maine - 51.75%

Oregon - 54.5%

Minnesota - 55.45%

New York - 55.5%

New Jersey - 55.5%

California - 57.9%

This will bring vital investment in start-up companies to a standstill!

3:57 PM · May 7, 2024

Thomas Del Beccaro

@tomdelbeccaro

The result will be predictable:

1. Assets sales will drop because the tax on sales is too high.

2. Asset values will drop because the high tax will weaken supply.

3. Capital gains tax revenue will drop as sales drop.

4. CA saw a drop in Public Offerings of stock from 191 in 2022 to just 25 in 2023 causing higher deficits in CA. The proposed Biden tax will only make that worse as companies look for other states for lower taxes. That will result in CA Democrats looking to raise income taxes.

5. Less public offerings will reduce economic growth because companies will not be able to raise capital to expand and hire employees.

As Calvin Coolidge said, a tax that is too high is not paid. Once again.

8:19 PM · May 7, 2024