« on: February 17, 2022, 12:58:48 pm »

Canada is also viciously attacking one of its largest natural gas fields supplying a bounty of energy.

Wednesday, 02/16/2022

Published by: Martin King

The gradual increase in Western Canada’s natural gas production in recent years has been powered by the highly prolific Montney formation, a vast unconventional resource that straddles the Alberta/British Columbia border. With Western Canadian gas price benchmarks at multi-year highs and producers enjoying their best financial position in ages, it would seem logical to expect more gas production growth from the Montney in the future. However, a recent ruling by the BC Supreme Court could negatively affect the pace of well developments and jeopardize future growth in the Montney formation. In today’s RBN blog, we consider this possibility.

Since the early 2010s, Western Canada’s natural gas production has been experiencing a slow renaissance. Driven by many of the same factors that have revived U.S. gas production in the past 10 years — a greater focus on unconventional gas resources, a near-exclusive shift to horizontal drilling, and ever-improving hydraulic fracturing techniques — Western Canada’s gas production has been regaining the mojo it had in the late 1990s and early 2000s, and could be on the cusp of achieving record-high average production in 2022.

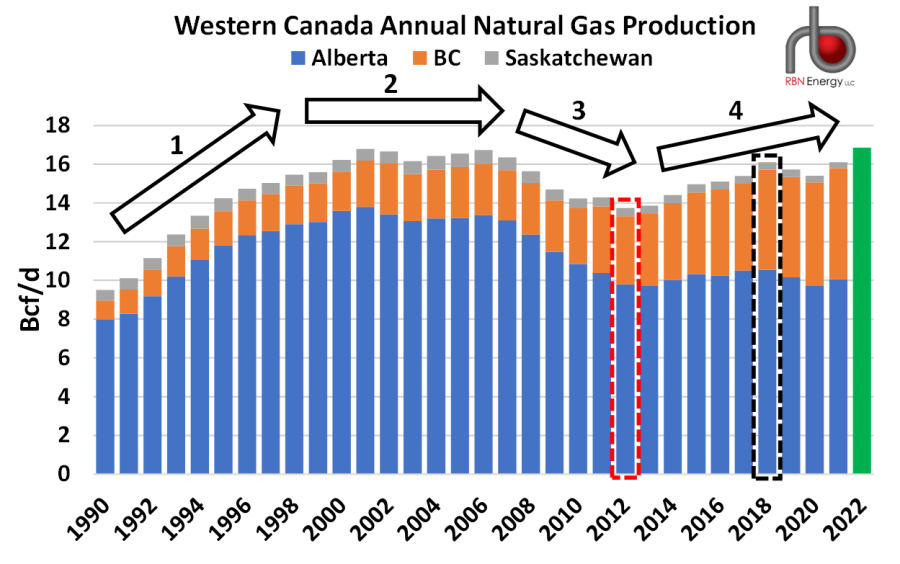

Getting back to record production levels has not been easy. Over the past 32 years, gas production from Saskatchewan, Alberta and British Columbia has been on a slow-motion roller coaster (stacked bars in Figure 1). For most of the 1990s, production in the three provinces expanded (Arrow #1) to fill new export pipelines at a time when U.S. supplies were either stagnating or falling, and demand was steadily increasing. Over this time, Canada had plenty of spare gas resources that it could develop and export to its only neighbor. By the start of the 2000s, rising gas prices had begun to strangle demand and output from the shallow, conventional gas wells that had been powering Western Canada’s production-and-export expansion in the 1990s and early 2000s reached their peak and stayed flat (Arrow #2). By 2008, however, the U.S. Shale Revolution took off, eventually flooding the market with more locally sourced supplies, reducing the need for Canadian gas and leading to a fall in production as a result (Arrow #3). It was only in 2012 that Western Canada’s gradual gas production renaissance began to get under way (Arrow #4) as producers focused on more unconventional gas plays like the celebrated Montney formation, relentlessly reduced drilling-and-production costs, and began to more aggressively apply horizontal drilling and hydraulic fracturing practices to access more and more gas resources.

After bottoming out at 13.7 Bcf/d in 2012 (dashed red rectangle), production grew to 16.1 Bcf/d by 2018 (dashed black rectangle), marking a near 18% increase over six years. Production pulled back in 2019 and 2020 as extremely weak gas prices in Western Canada — partly related to the region’s pipeline constraints — hobbled producers who reduced drilling and cut output further (see Don’t Do Me Like That for a historical perspective). Those constraints have been easing in the past 12 to 18 months (see I Can’t Help Myself and Better Late Than Never) as connectivity within Western Canada’s gas pipeline network has expanded, allowing gas production to more fully access Canadian and U.S. markets.

Logged

No punishment, in my opinion, is too great, for the man who can build his greatness upon his country's ruin~ George Washington