https://www.cnbc.com/2020/12/27/wells-fargos-2021-forecast-includes-a-warning-for-tesla-investors.html

https://www.cnbc.com/2020/12/27/wells-fargos-2021-forecast-includes-a-warning-for-tesla-investors.html<snipit>

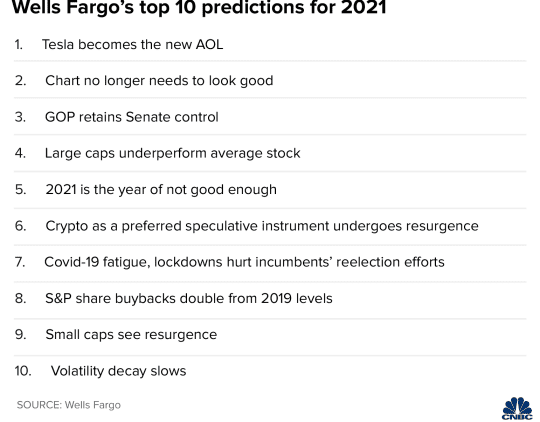

Wells Fargo Securities’ Chris Harvey is out with the bank’s top 10 predictions for next year.

No. 1 on his list: Tesla becomes the new AOL.

“It reminded us so much about 1998 — the late ’90s,†the firm’s head of equity strategy told CNBC’s “Trading Nation†last week. “AOL, similar to Tesla had a game-changing technology, incredible performance [and] it goes into the [S&P 500] index late in the year in December after an amazing run. But it was a seminal event.â€

AOL, the former king of media, saw its influence unravel because it failed to keep up with the rapid pace of technology. Harvey warns that the electric auto maker could suffer a similar fate. His warning comes as Apple looks to take on Tesla by producing its own self-driving vehicle by 2024.

“After ’99, many tech and growth companies lost 50% to 100% [of value],†said Harvey. “We’re thinking in 2020, everything happens much faster. So, if it took 12 months for the end to begin, now it’s going to take six months.â€

Tesla stock has surged almost 700% this year.

Its record run is one of the reasons why Harvey tells clients to avoid thinking about growth at any price.

“They need to start looking at cyclicality. They need to start thinking about getting more high Covid-beta names in their portfolios,†he said. “Old economy, not new economy.â€

===================================================================================

===================================================================================

Love seeing EOY predictions like these... Like the old saying "opinions are like AH's....everyone has one. Well I'll weigh in on Wells Fargo's speculation of how likely each of these predictions are:

1. 90%. I have never made a secret of my disdain for TSLA. And right now this is the most over speculative play I have seen in the markets since the '00 crash.

2. 15%- Market performance is, has , and always mattered, no matter where on the cycle.

3. 40%- Never underestimate the dimocratic party's ability to steal an election.

4. 35%- When the reality of the Biden economy starts sinking in . (late year, my best guess now), I see flight to safety... And that means safe large cap's.

5. 85%- I think we are going to see addtional earnings erosion during the year due to pandemic lockdowns. Many companies relying on cash reserves, are going to start feeling the pinch. When the earnings misses starts piling up (esp. again late year), equity prices will slide accordingly.

6. 90%- I have never ventured into this area, but if these guys want their modern day Tulips.... have at it.

7. ??%- Strange prediction since '21 is not an election year. But if the author's claim was around '22. Then this is very very likely.

8. 50%- Flip a coin on this one. Will there be enough buy backs to sustain stock pricing, or will company cash reserves be needed sustain business. I have no idea.

9. 40%- Small caps often thrive in turbulent times due to innovation needs. But, will there be enough VC money out there?

10. 95% Not only does it slow, I see a significant VIX uptick at the next correction. Because... honestly.... does anyone think the DJIA is sustainable at 30K in a Biden administration?